One Week Left to Apply for Federal Disaster Assistance

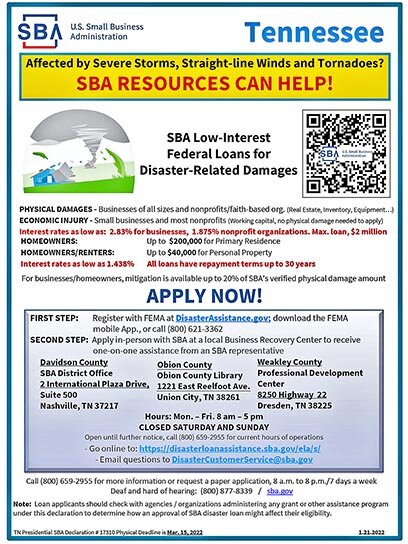

With one left to file for federal assistance as a result of the December 10, 2021, tornado that hit Weakley County and other parts of Tennessee, as well as Kentucky, the Small Business Administration is encouraging those impacted by the storms to visit the Weakley County Personal Development Center on Highway 22 before the March 15 application deadline. By scanning the QR code shown in the graphic, a link filters directly to the application for assistance.

With one left to file for federal assistance as a result of the December 10, 2021, tornado that hit Weakley County and other parts of Tennessee, as well as Kentucky, the Small Business Administration is encouraging those impacted by the storms to visit the Weakley County Personal Development Center on Highway 22 before the March 15 application deadline. By scanning the QR code shown in the graphic, a link filters directly to the application for assistance.DRESDEN (March 8) – Homeowners and renters affected by December’s tornadoes in Weakley County have until next week to apply for federal disaster assistance. All residents and businessowners in Weakley County that were affected by the tornados in December 10-11, 2021, are encouraged to apply for disaster assistance with the Small Business Administration (SBA) before March 15. The State of Tennessee has opened Centers where SBA has staff ready to start an application for disaster assistance. The closest location is in Dresden at the Weakley County Personal Development Center, located at 8250 TN Hwy. 22, Dresden, open weekdays only from 8 a.m. to 5 p.m. Everyone is urged to come and start the application process after registering with FEMA.

As outlined in a Major Disaster Declaration, residents of Henry, Lake, Obion, and Weakley counties have until Tuesday, March 15, to apply for FEMA grants and physical loss loans with the U.S. Small Business Administration (SBA).

There are several ways to apply and register for FEMA assistance:

Create an online account at DisasterAssistance.gov.

Use the FEMA app, which can be easily downloaded to a smartphone, or

Call the FEMA Helpline at 800-621-3362. Specialists are available from 7 a.m. to 10 p.m. local time, seven days a week. Multilingual services are also available.

If you use a relay service, such as video relay service (VRS), captioned telephone service or others:

Update the "Current Phone" field using the relay service phone number

Add "Relay Service" to the Note box; provide FEMA with your number.

After you submit your FEMA application, you may be referred to the SBA. The SBA offers low-interest disaster loans for businesses, homeowners and renters. There’s no obligation to accept a loan and it’s free to apply. Currently, interest rates for physical loss loans are as low as 1.38 percent for homeowners and renters. For businesses, it’s at 2.830 percent and for nonprofits it’s 1.875 percent. Disaster assistance loans from SBA up to $2 million are available for businessowners, up to $200,000 dollars for homeowners and up to $40,000 for renters, with terms up to 30 years.

What Types of Disaster Loans are Available from SBA?

Business Physical Disaster Loans – Loans to businesses to repair or replace disaster-damaged property owned by the business, including real estate, inventories, supplies, machinery and equipment. Businesses of any size are eligible. Private, non-profit organizations such as charities, churches, private universities, etc., are also eligible. The law limits business loans to $2,000,000.

Economic Injury Disaster Loans (EIDL) – Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.

Home Disaster Loans – Loans to homeowners or renters to repair or replace disaster-damaged real estate and personal property, including automobiles.

What are the Credit Requirements?

Credit History – Applicants must have a credit history acceptable to SBA.

Repayment – Applicants must show the ability to repay all loans.

Collateral – Collateral is required for physical loss loans over $25,000 and all EIDL loans over $25,000. SBA takes real estate as collateral when it is available. SBA will not decline a loan for lack of collateral, but requires you to pledge what is available.

Did you know?

SBA disaster loans can cover the difference between an insurance settlement and what is needed to fully recover. If a survivor has not settled their insurance claim, SBA will consider making a loan for the total loss up to its loan limits. The insurance settlement will be used to reduce or repay the loan.

FIRST STEP: Register with FEMA at DisasterAssistance.gov or download the FEMA mobile App., or call (800) 621-3362.

SECOND STEP: Apply with SBA for a fiscal damage or economic injury disaster loan related to this disaster TN 17310/17311.

How to apply: In person at the Weakley County Personal Development office on Highway 22, on-line via SBA’s secure website at https://disasterloanassistance.sba.gov/ela/s/ (Home (sba.gov)), or by mail to: U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

FEMA disaster assistance can provide grants for temporary housing (such as rental assistance or reimbursement for hotel costs), repair or replacement of a homeowner’s primary residence, repair of storm-damaged privately-owned access routes, such as driveways, and other uninsured or under-insured disaster-related expenses including moving and storage fees, childcare, medical, dental expenses and certain funeral costs.

Residents are also encouraged to file insurance claims for tornado damage to their homes, personal property and vehicles. Federal grants do not have to be repaid, and disaster assistance is nontaxable and does not affect eligibility for Social Security, Medicaid or other federal benefits.

For more information on Tennessee’s disaster recovery, visit www.tn.gov/tema.html and www.fema.gov/disaster/4637. You may also follow FEMA on www.facebook.com/fema and Twitter@FEMARegion4.

Small businesses and most private nonprofit organizations in the following adjacent counties are eligible to apply only for SBA Economic Injury Disaster Loans: Benton, Cannon, Carroll, Chester, Crockett, Decatur, DeKalb, Dyer, Hardin, Hickman, Houston, Humphreys, Macon, Madison, Montgomery, Robertson, Rutherford, Smith, Trousdale and Williamson in Tennessee, Allen, Calloway, Christian, Fulton, Graves, Hickman, Simpson and Trigg in Kentucky, and New Madrid and Pemiscot in Missouri.